avalara tax exempt codes

Meaning if your customer is exempt referencing a taxable tax code will still generate a zero tax result. API solutions for end-to-end tax compliance.

Set Up Avalara Avatax Integration Accounting Seed Knowledge Base

Mixed products and baskets wherein exempt items constitute 90 to 100 of the total value of the basket or container ie.

. These tax codes are taxed at the full rate. An exemption certificate number identifies a buyer as exempt. CustomerCode Set to DEF.

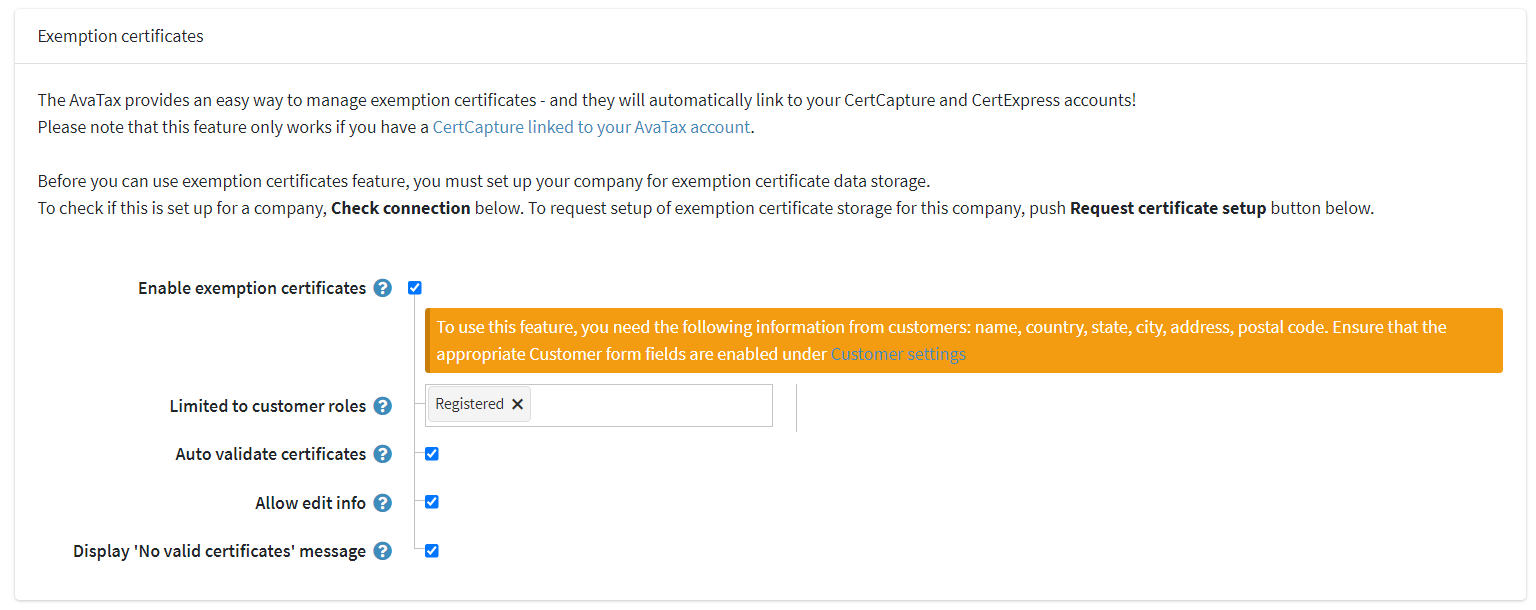

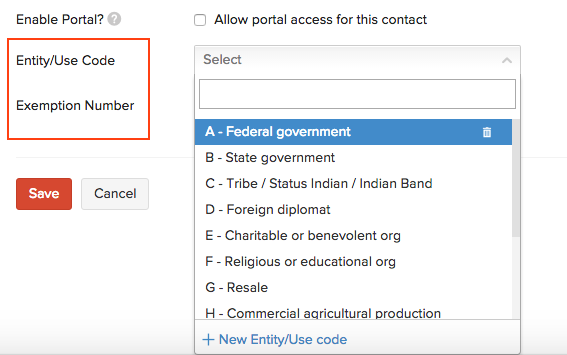

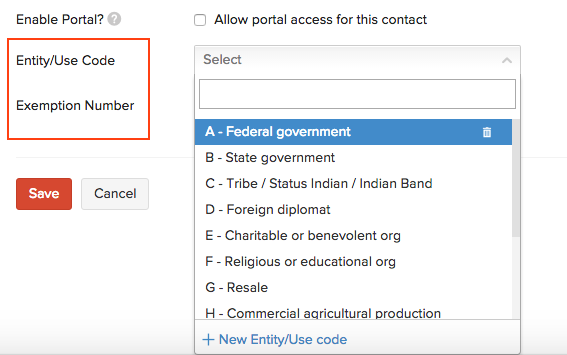

Make sure entity use codes are enabled in your system before you assign one to a customer. You can modify the behavior of these codes and create your own. At the top right of the page you will see the branded Avalara tax codes button.

Assign AvaTax code. These codes indicate pre-populated customer taxability profiles present in the AvaTax system. In the Exempt Override Code field type an exempt override.

US Medical Device Excise Tax with taxable sales tax. Its important to note that there is a maximum of 100000 items per import. US Medical Device Excise Tax with exempt sales tax MED2.

AvaTax uses entityuse codes to identify a customers tax status. If you must map more than 100000 SKU codes to. To exempt a customer enter the buyers exemption number on the invoice when making a sale.

Go to Advanced Account Settings. AvaTax exempts the transaction as long as the code is valid. Same of nexus and tax rules.

US Medical Device Excise Tax with exempt sales tax MED2. You can modify the behavior of these codes and create your own. Enter an entity use code in the transaction you send to AvaTax.

Navigate to Configuration Tax categories. AvaTax exempts the customer purchase from tax. CompanyCode Date set to reasonable default values.

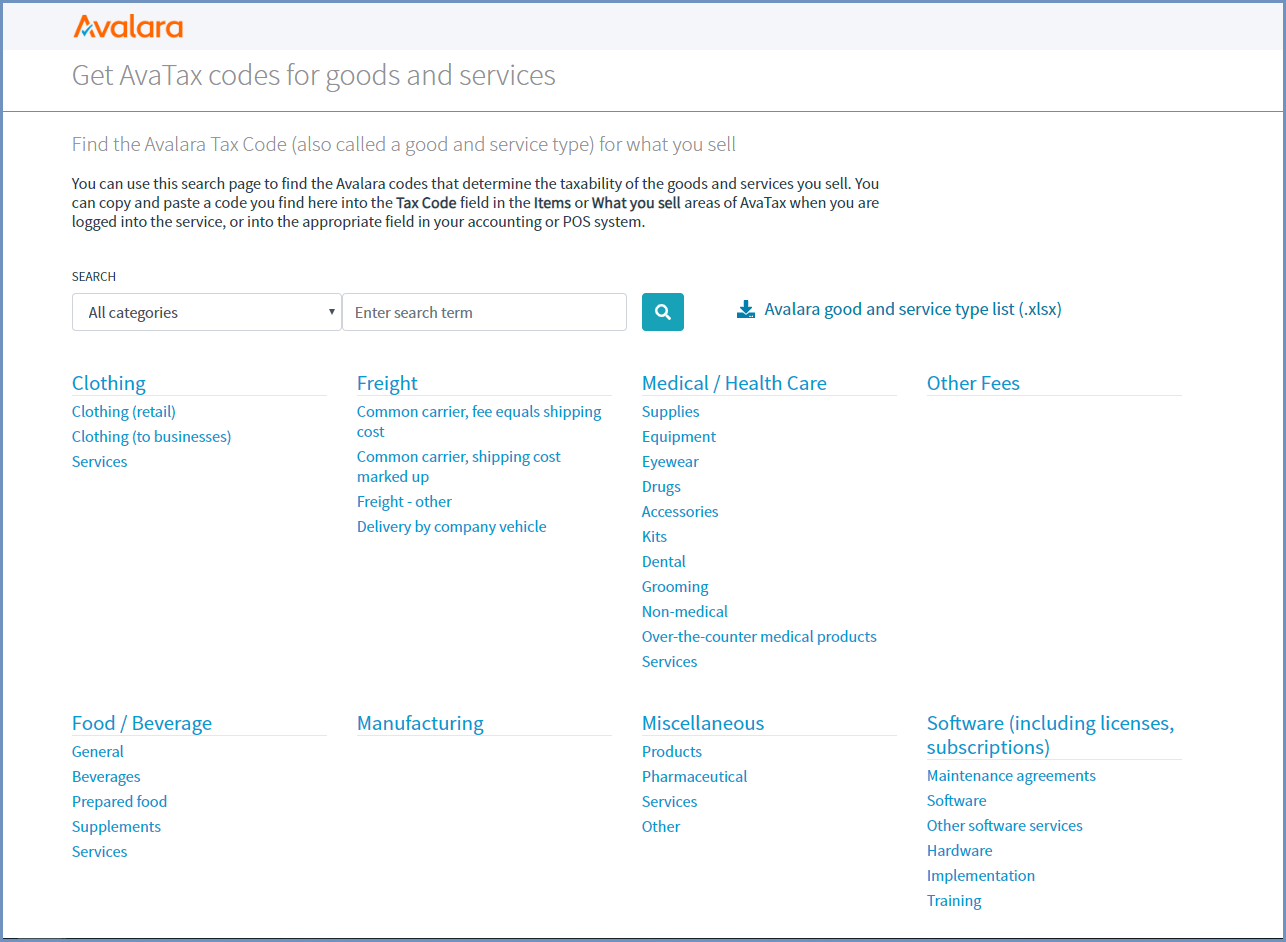

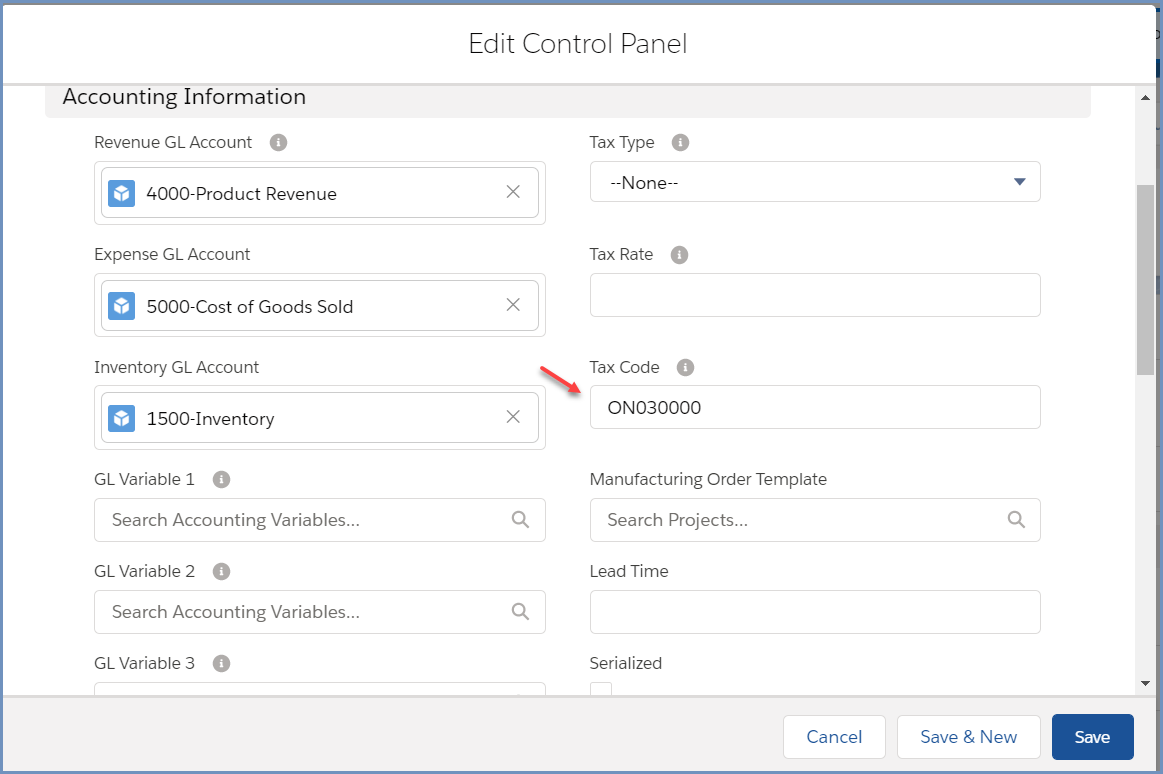

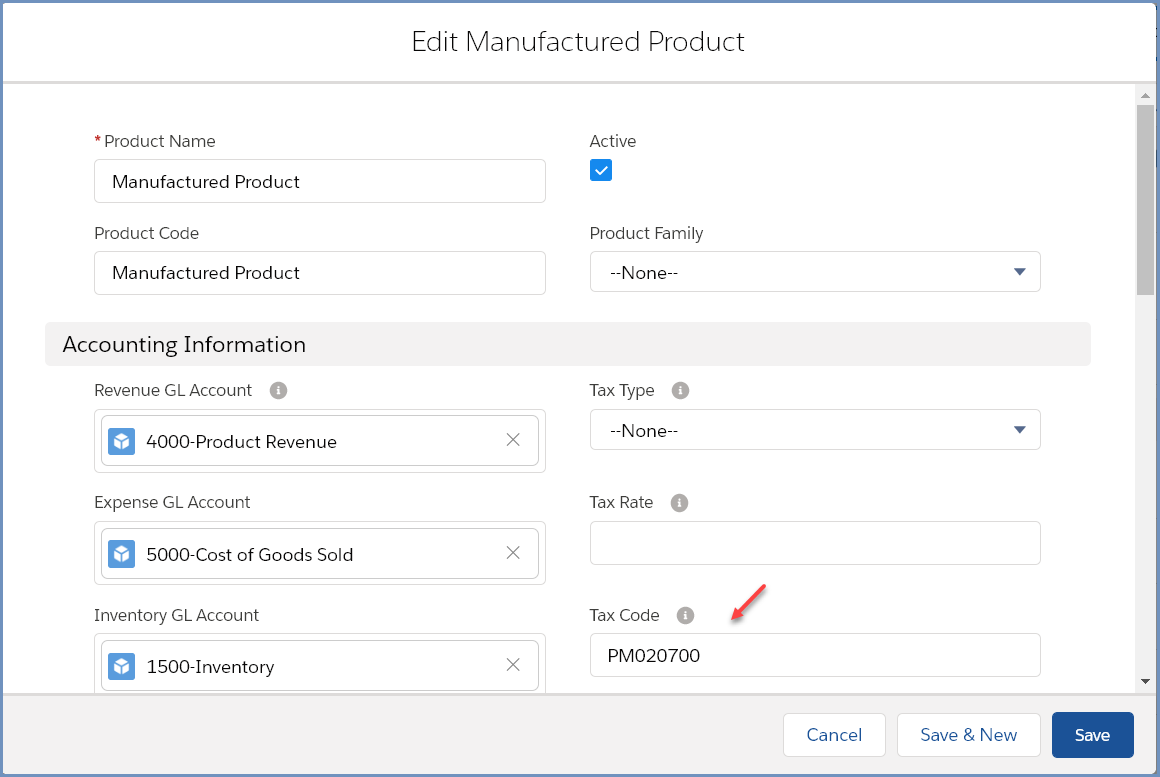

Map an entity use code to a customer to exempt them on. You can use this search page to find the Avalara codes that determine the taxability of the goods and services you sell. P0000000 and U0000000 are generic codes that are used when you have items that arent mapped to an Avalara tax code.

For more information about available entity use codes see exemption reason matrices. Tax operations not allowed for an inactive company. AvaTax has a default Tax Code P000000 which will be used to calculate taxes on Products that are not mapped to a specific.

Fruit baskets PG081618 Mixed products and baskets wherein. Clicking it will show the following. AvaTax uses an entityuse.

You can copy and paste a code you find here into the Tax Codes field. Non-taxable Products must be mapped to the correct Tax Code. In the Avalara Home page menu go to Settings All AvaTax Settings.

If you are getting a gettax result for a jurisdiction that you. TaxCode the Avalara Product Tax code for the variant. US Medical Device Excise Tax with taxable sales tax.

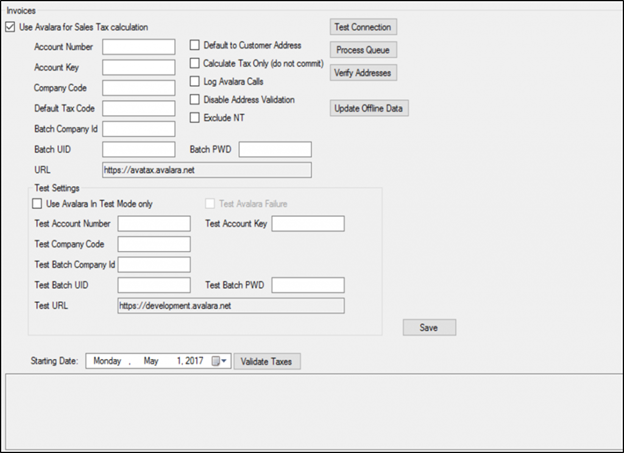

For example if you use QuickBooks Desktop go to File AvaTax Preferences Customer Exemptions and make sure the Use Entity Use Codes box is selected.

Wix Stores Creating Tax Groups For Products With Avalara Help Center Wix Com

Avalara Avatax Integration Help Zoho Books

Product Update 393 Sales Tax Integrated With Avalara American And Canadian Legislations

Software Sales Tax Solutions Avalara

Why Sales Tax Is Still Being Charged In Spite Of Customer Tax Exemption Using Avalara Integration Chargebee Help Center

Customer Exemption And Product Tax Types In Avalara Brightpearl Help Center

Avalara Integration Fast Weigh

Avalara And Vertex Integration In Sap Business Bydesign Sap Blogs

Avalara B2b Wave Knowledge Base

Set Up An Account Or A Product As Tax Exempt With Avatax Accounting Seed Knowledge Base

Who You Exempt Avalara Help Center

Set Up Avalara Avatax Integration Accounting Seed Knowledge Base

Avalara Sales Tax Guide For Sage Users With Demonstration Of Avatax And Certcapture Youtube