salt tax cap repeal 2021

The deduction of state and local tax payments known as SALT from federal income taxes has been a subject of debate among economists and policymakers over the past few years with significant implications for our budget and fiscal outlook. Their states created an optional tax letting owners of passthrough entitieswhere income flows through and is taxed on the ownership levelcircumvent the 10000 limit on deductions.

The Latest Salt Cap Fix Would Mostly Benefit High Income Households Do Little For Middle Income People

This would be in place of the House plan to lift the cap to 80000 through 2030 and reinstate it at 10000 for 2031.

. The top 1 would only get 01 of the benefit if the 10000 SALT cap is gradually restored beginning at 400000. Heres how Democrats plans affect Americans with big state and local tax bills. Expansion of SALT Cap Workaround SB 113 expands the SALT cap workaround by allowing the credit for taxes paid by the entity to offset the California tentative minimum tax of 7 percent of taxable income for tax years beginning on.

CLICK HERE TO READ MORE ON FOX BUSINESS Middle-income households would get an. July 6 2021 What Is the SALT Cap and Why Do Some Lawmakers Want to Repeal It. The prudent course does appear to be to properly elect if applicable and pay by Dec.

A Democratic proposal aims. Harvard economics professor Jason Furman posted on Twitter that the majority of Americans with a net worth of 50 million to 300 million would get a tax cut under the Build Back Better plan. The current proposal agreed to in an amendment late last week would increase the cap from 10000 to 80000 through 2030.

Americans who rely on the state and local tax SALT deduction at tax time may be in luck. That was bad news for top earners in blue states such as California and New York. New York and Idaho both recently passed legislation to work around the controversial 2017 tax law feature known as the SALT cap.

These states offer a workaround for the SALT deduction limit For 2021 the standard deductions are 12550 for single filers or 25100 for married couples filing together meaning they wont. Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction according to new estimates by the Tax. While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to reduce the tax break for the wealthy.

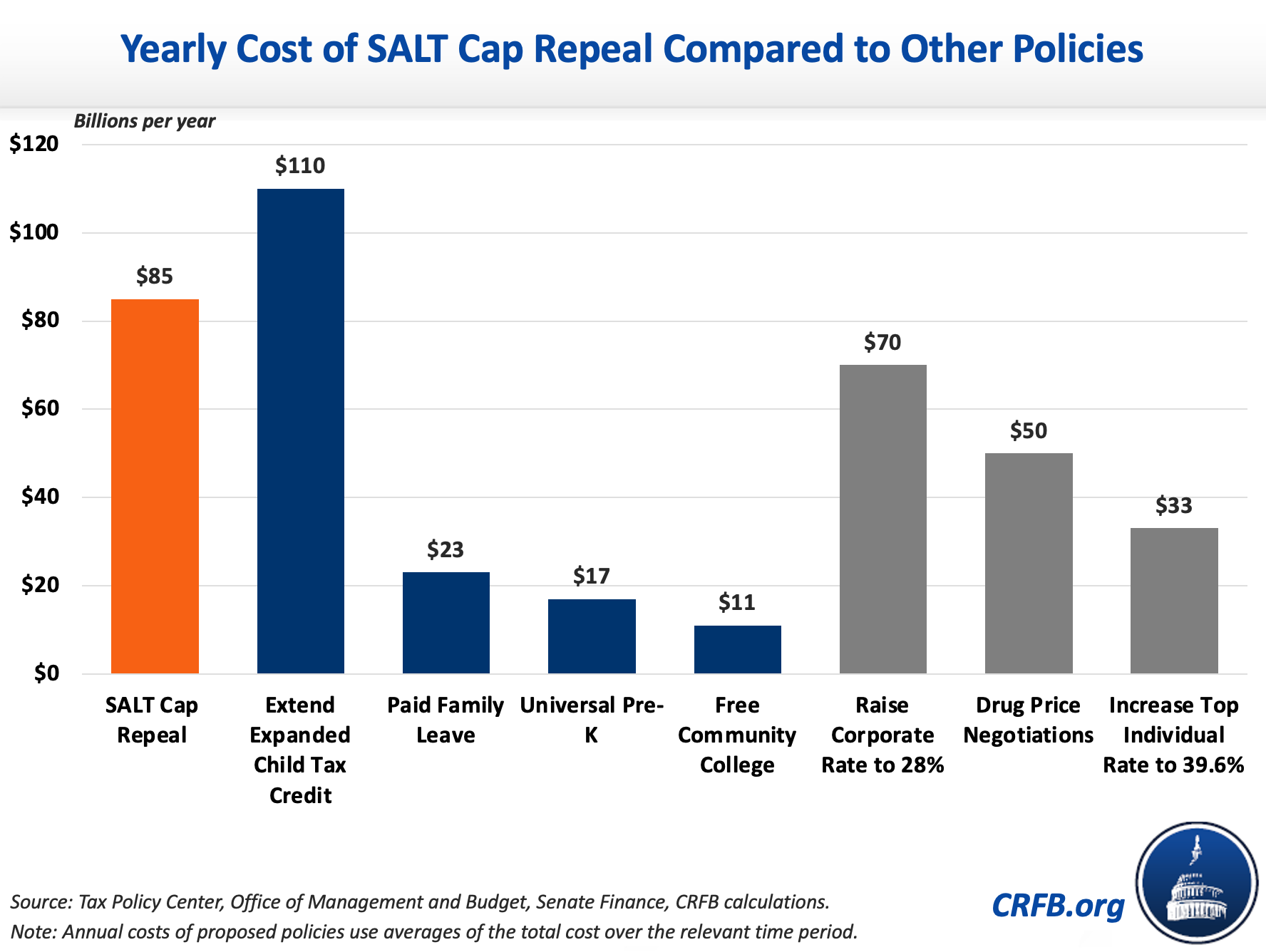

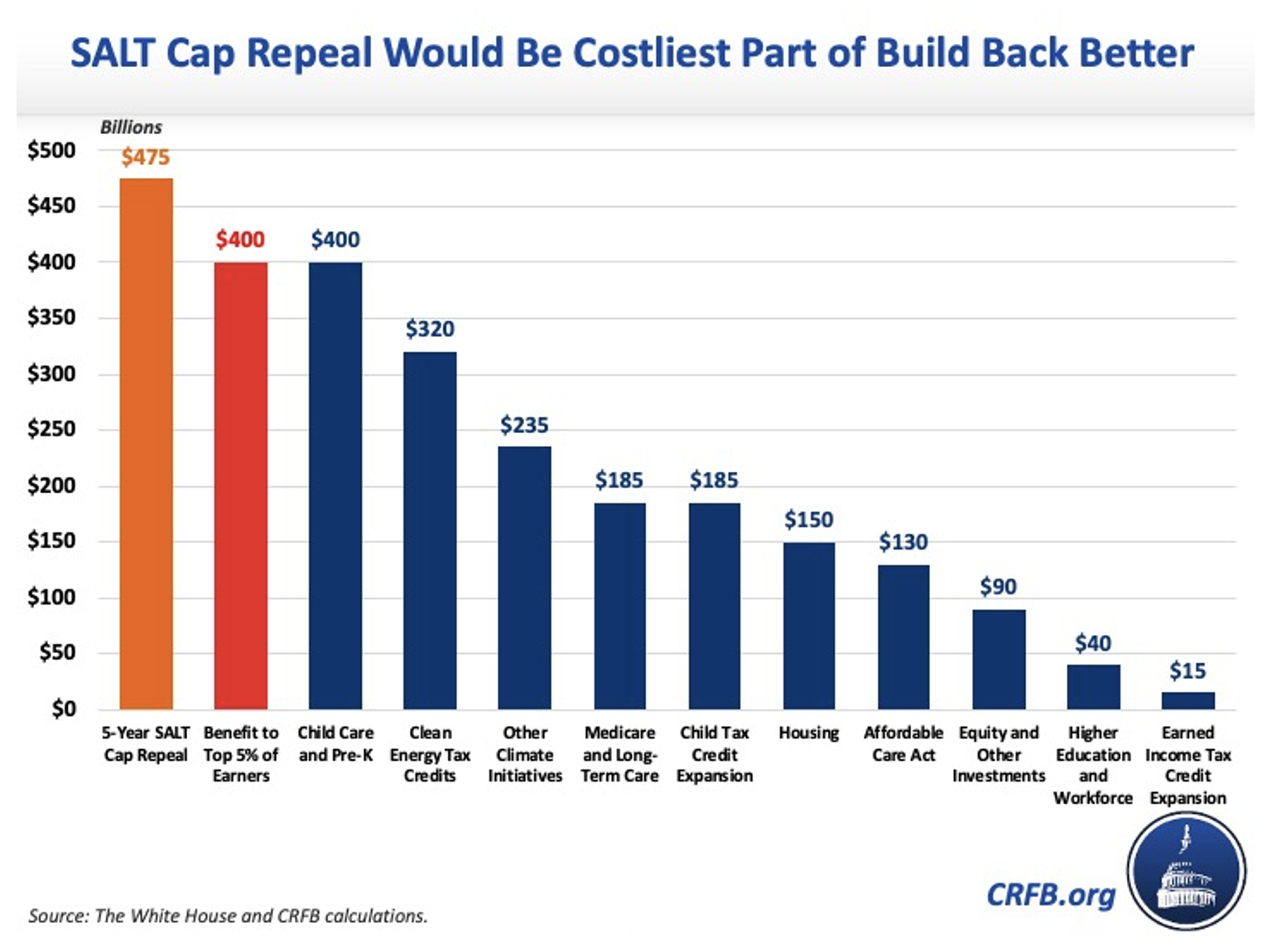

The early repeal of the NOL suspension and business credit limits comes amid strong tax revenues and a 457 billion budget surplus. Certain members of the House and Senate want the SALT deduction cap removed which would benefit primarily higher earnersand result in a 380 billion reduction of federal revenue. Published May 1 2021 Updated May 3 2021 In 2017 congressional Republicans capped a tax break that benefits Americas highest-earning households and people with multimillion-dollar homes.

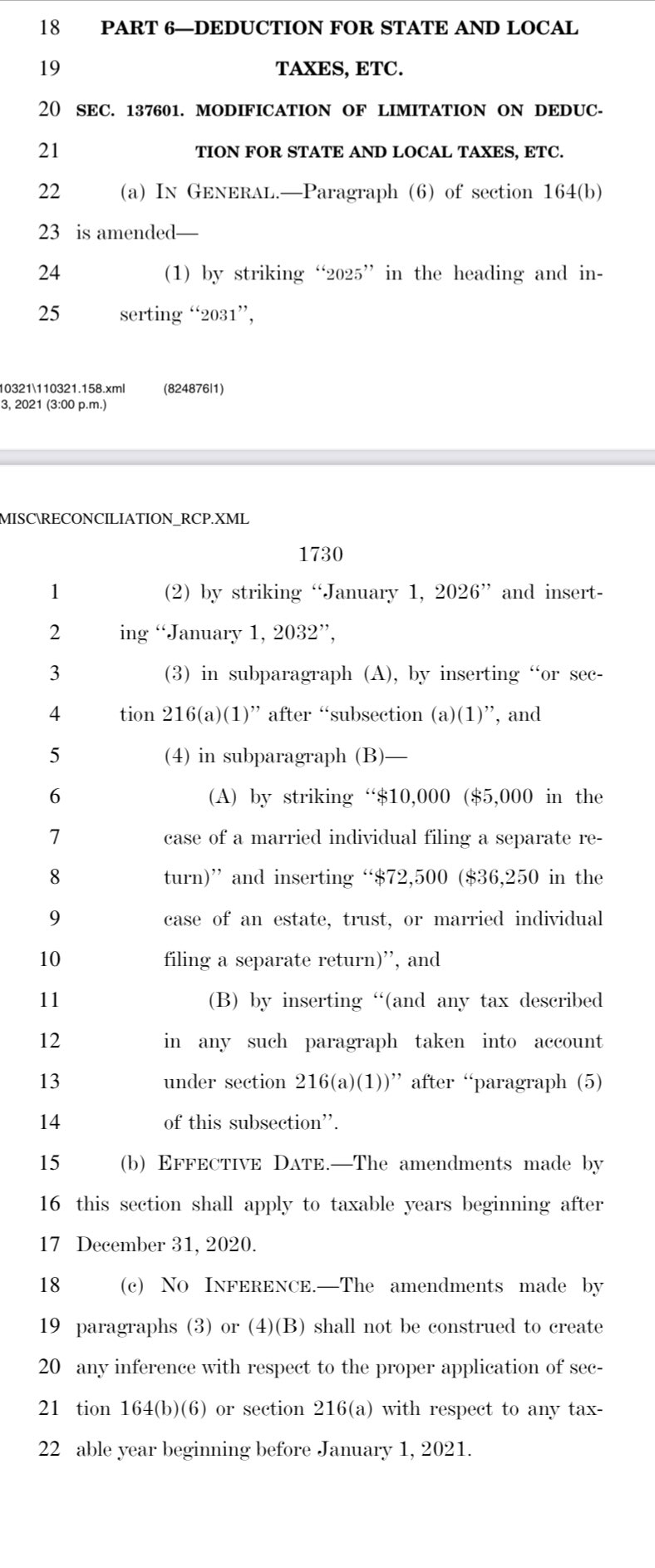

April 19 2021 628pm Updated Gov. It was a last-minute tweak. Dec 2 2021 Taxes Several senators are apparently pursuing revenue neutral state and local tax SALT deduction cap relief meaning the cost of increasing the SALT deduction cap through 2025 would be fully paid for on paper by extending it past its current expiration date of 2026 through 2031.

2021 203 PM UTC Updated on. But the Tax Cuts and Jobs Act limited that deduction to 10000. 31 2021 depending on the state PTE regime in order to benefit from the SALT cap deduction in 2021 Many firms are advising clients to pay the tax by year end to be on the safe side and comply with the four corners of the notice Scott said.

Nov 19 2021 Taxes According to press reports the Senate is considering repealing the 10000 cap on the state and local tax SALT deduction for those making 500000 per year or less. A rollback of the cap on the state and local tax SALT deduction is on ice after Sen. A new bill seeks to repeal the 10000 cap on state and local tax deductions.

Andrew Cuomo says President Bidens infrastructure package should include repeal of the SALT cap. Joe Manchin D-WVa raised broader objections to President Bidens social spending and climate package. Over 50 percent of this reduction would accrue to taxpayers in just four.

Repealing the SALT cap in 2021 would reduce federal income tax liability by approximately 91 billion or 72 percent. President Joe Biden s decision in a raft of individual tax proposals released Wednesday to leave in place a cap on state and local tax deductions threatens to complicate congressional negotiations over his sweeping new social-spending program. Will see the most noticeable effects from lifting the.

The omission disappoints a group of Democratic lawmakers pushing to remove the 10000 cap on state and. Paying a state income tax of 10 percent or more. Repealing the SALT cap in 2021 would reduce federal income tax liability by approximately 91 billion or 72 percent.

Over 50 percent of this reduction would accrue to taxpayers in just four. The 10000 limit would then return in 2031. AFP via Getty Images Various Democrats and some Republicans in.

As President Bidens tax plans are considered in Congress the future of the 10000 cap for state and local tax deductions SALT is becoming an important part of the tax debate.

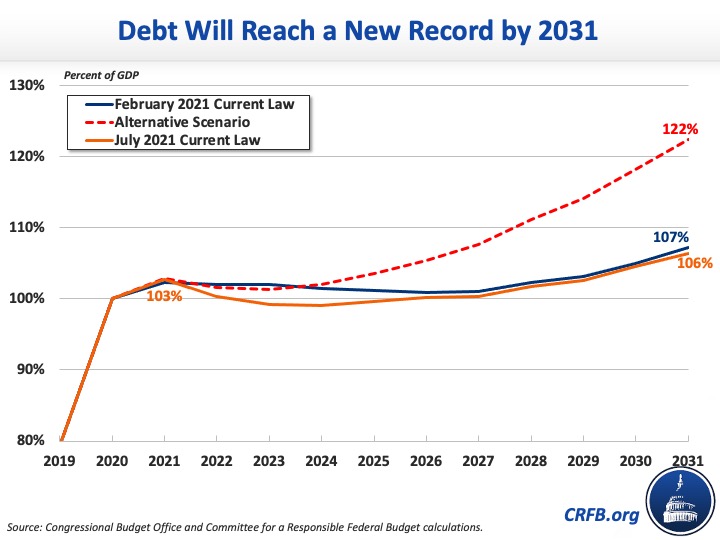

Our Top 21 Fiscal Charts Of 2021 Committee For A Responsible Federal Budget

U S Lawmakers Pepper Congress With Pleas For Salt Tax Break Florida Phoenix

Tax Salt Committee Abataxsalt Twitter

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

Latest Proposal From Senate Democrats Would Bar The Rich From Salt Cap Relief Itep

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Chinese Stock Educational Technology Education Related Student Loans

Wealthy Americans May Get 10 Times Bigger Tax Cut Than Middle Class Families In Biden Bill

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

Salt Cap Repeal Would Worsen Racial Income And Wealth Divides Itep

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Dems Hike Taxes On Middle Class To Pay For 475b Salt Tax Shelter For Rich Ways And Means Republicans