are delinquent taxes public record

At that point you could take possession of. Penalties and interest begin to accrue on the unpaid tax until the entire balance is paid in full.

Delinquent Taxes Oldham County Clerk

A lien filed at a county Register of Deeds becomes a public record.

. A prior owner who was not the record owner as of January 6 may not be held personally responsible for taxes on the real property in question. Whats more the tax office must advertise delinquent tax liens in the name of the January 6 record owners and not in the name of prior owners. For your convenience Tax Master records now have a link to the corresponding delinquent tax document in our On-line Land Records.

Complete information is available at the Professional License and Delinquent Tax Department in Room 100A of Metro Hall at 527 W. Last Known Mailing Address. Arkansas County Assessor and Collector.

The information displayed reflects the. Send a completed Form 4506-T. Showing results 1 through 250 out of 19349.

105-3651 b 1. If you dont respond to letters or notices and your account continues to be delinquent it is assigned to a Revenue Agent for collection. Become a Notary Public.

In counties where no taxpayer has warrants or liens totaling 100000 the two taxpayers with the highest amount of warrants or liens are included. The Revenue Agent will attempt to contact you by telephone letter or in person to resolve the delinquency. No tax sale payments will be taken in the delinquent tax office on the day of the tax sale.

See Property Records Tax Titles Owner Info More. Delinquent tax sale begins at 1000 am. An additional 30 fee will be added to all real property bills and an additional 40 fee will be added to all mobile home bills if the taxes penalties and assessment fees are not paid by 500 PM on Friday April 23 2021.

Public Auction Tax Sales. View the tax delinquents list online. Ad Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More.

Search Unlimited Public Records and See Full Details Instantly. Location to be determined extra copies of the lexington chronicle will be sent out to chapin cayce gaston irmo pelion swansea and west columbia to allow greater coverage throughout lexington county. Seminole County Tax Collector PO Box 630 Sanford FL 32772-0630 407 665-1000 Email Contacts Email Public Records Custodian.

Assessor Phone 870946-2367 Fax 870946-1795. Search Any Address 2. Delinquent tax records are handled differently by state.

The warrant or lien is a public record filed with the Clerk of Court or other government office. Top 100 Delinquent Taxpayer - This lists the top 100 delinquent taxpayers for the current fiscal year. Enter Any Name Now.

In prior editions of the IRS Data Book Table 25 was presented as Table 16. 101 Court Square Dewitt AR 72042. Contact for View the Public Disclosure Tax Delinquents List.

As a general rule of thumb I. Jefferson Street Louisville KY 40202In a few instances there is a possibility. Assessor Collector and Delinquent Taxes.

Name Doing Business As. Once a lien is filed the taxpayers credit rating could be harmed and in most cases property cannot be sold or transferred until the past-due tax is paid. Typically a tax lien is placed on the property by the government when the owner fails to pay the property taxes.

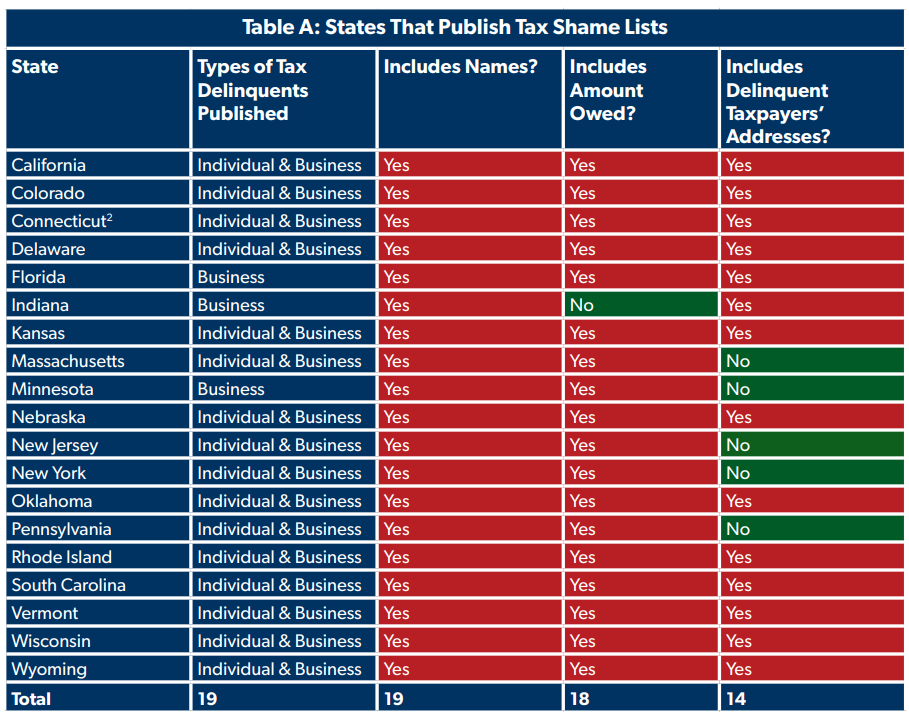

The list includes taxpayers who have unsatisfied tax warrants or liens totaling 100000 or more. 9 am4 pm Monday through Friday. Tax Department Call DOR Contact Tax Department at 617 887-6367.

Delinquent Property Tax Search. Ad Find Out the Market Value of Any Property and Past Sale Prices. The most common pricing I see is 25 cents per parcel and at this rate some lists can get pricey but in most cases its still worth the price.

Just Enter a Name and State. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. Ad You Can Now Find Public Records Online with a Simple Search.

In addition to the tax return and account transcripts available through the Get Transcript tool you may also request wage and income transcripts and a verification of non-filing letter. For delinquent tax bill searches prior to the current year please contact our software company at 1-800-466-9445 for online access OR you may visit our office Monday through Friday 830am 430pm. 2020 XLSX 2019 XLSX 2018 XLS 2017 XLS 2016 XLS 2015 XLS 2014 XLS 2013 XLS 2012 XLS 2011 XLS 20022010 XLS 19942001 XLS.

Return to the IRS Data Book home page. View detailed information about upcoming San Joaquin County public auction tax sale results of the previous tax sale and list of excess proceeds from the prior auction. Once a property tax bill is deemed delinquent after March 16th of each year a 15 past due penalty is added to the bill and the bill is sent to the Delinquent Tax Office.

Search Arkansas County property tax and assessment records by owner name parcel number or address. Delinquent Taxpayer Publication - This publication lists delinquent taxpayers with prior year delinquent taxes. Credit reporting agencies may obtain and publish the.

Delinquent Collection Activities by Fiscal Year. Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089. When delinquent or unpaid taxes are sold by the Cook County Treasurers office at an annual sale or scavenger sale the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount necessary to redeem pay your taxes and remove the threat of losing your property.

44 North San Joaquin St 1st Floor Suite 150 Stockton CA 95202. Eventually the lien owners may have to force foreclosure on the property to pay the liens. The cost of the full list from most counties will fall somewhere in between 100 500.

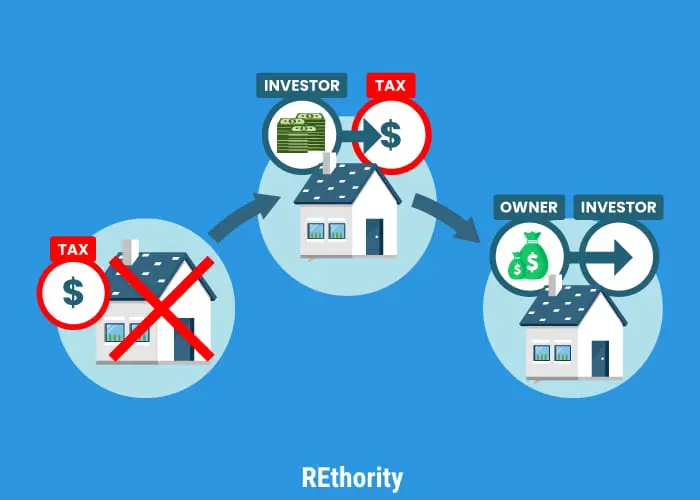

If left unpaid the liens are sold at auctions to the public.

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

How To Find Tax Delinquent Properties In Your Area Rethority

2020 Lucas County Auditor Delinquent Land Tax Notices The Blade

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

How To Find Tax Delinquent Properties In Your Area Rethority

How To Find Tax Delinquent Properties In Your Area Rethority

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Detroit Real Estate 15491 Lauder St Detroit Mi 48227 Renting A House House Construction Builders

Delinquent Tax Sale Surplus Sale

Notice Of Delinquency Los Angeles County Property Tax Portal

Delinquent Taxes Oldham County Clerk

How To Find Tax Delinquent Properties In Your Area Rethority

How To Find Tax Delinquent Properties In Your Area Rethority

How To Buy A Property With Delinquent Taxes New Silver

At Least 19 States Still Publish Draconian Shame Lists For Delinquent Taxpayers Foundation National Taxpayers Union

One Of The Steps In Buying A Home Is To Have A Title Search Completed Prior To Closing Many First Time Buyers May Not Hav Title Insurance Title Things To Know

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

How To Find Tax Delinquent Properties In Your Area Rethority